Are you burdened by debt? Don't let it to control your fiscal future. At [Your Company Name], we offer effective solutions tailored to guide you achieve financial security. Our team of experienced experts will work collaboratively with you to create a tailored plan that meets your specific needs. Reach out us today and begin on the path to debt settlement.

Achieve Financial Freedom: Debt Consolidation Simplified

Are you experiencing by a mountain of debt? It can feel like an insurmountable obstacle to achieving your financial goals. But there's good news: debt consolidation can deliver a powerful solution to simplify your finances and pave the way to freedom. This process involves combining multiple debts into one single loan with a hopefully lower interest rate, resulting in manageable monthly payments. A well-structured consolidation plan can free up your cash flow, allowing you to focus on building your financial future.

- Investigate different debt consolidation options such as balance transfers or personal loans.

- Estimate how much you could save by lowering your interest rate.

- Talk to a financial advisor for personalized guidance.

Take control of your finances today and embark on the journey to financial freedom through debt consolidation!

Bargain Lower Payments: Effective Debt Settlement Strategies

A crucial step in effectively settling your debt is learning how to bargain lower payments with your creditors. By taking a proactive approach and applying some strategic techniques, you can potentially minimize your monthly obligations. First and foremost, it's important to investigate the legal frameworks surrounding debt settlement in your jurisdiction. Familiarize yourself with any guidelines that may influence your negotiations.

Develop a comprehensive plan outlining your financial situation, objectives, and the amount you're willing to pay.

When reaching out your creditors, be courteous while remaining firm in your need to reduce your payments. Highlight your financial hardships and explain your commitment to resolve your debt in a fair manner. Be prepared to provide supporting documentation, such as income statements or proof of expenses.

Remember that successful debt settlement often requires determination. Don't be afraid to contact your creditors regularly and reiterate your offer.

Ultimately, the path to lower payments may involve compromise on both sides.

Challenge Unjust Debt Claims: Secure Your Monetary Freedom

Are you burdened by debt that feels questionable? You're not alone. Many individuals find themselves trapped by unscrupulous lending practices and predatory debt collectors. It’s crucial to remember that you have rights as a consumer, and it is crucial to enforce them when your finances are at stake.

Never letting unfair debts control your life. By understanding your legal options and implementing strategic action, you can fight back against these harmful practices.

- Research thoroughly the laws governing debt collection in your state.

- Review all debt records carefully for errors.

- Negotiate with creditors and collectors to dispute the debt reasonably.

Remember, you have the power to protect your financial well-being. Engage with experienced legal counsel if needed, and consistently hesitate to exercise your rights as a consumer.

Tackle Debt Stress: Personalized Resolution Plans

Are you feeling overwhelmed by financial burdens? Debt can be a significant source of stress, impacting your physical well-being and overall quality of life. The good news is that there are effective strategies to control debt and reclaim your calm of mind. A personalized resolution plan can guide you toward financial freedom, step Menopause Support Products by gradually.

Working with a qualified debt specialist allows for an in-depth analysis of your individual situation. They will help you formulate a tailored plan that addresses your needs, taking into account your income, expenses, and existing liabilities.

This plan may involve strategies such as credit counseling to help you pay down your debt load in a manageable way.

Remember, taking ownership of your finances is essential for reducing stress and achieving long-term financial success. A personalized resolution plan provides the support you need to navigate your debt journey with confidence and achieve lasting freedom.

Optimize Your Budget: A Guide to Debt Control

Overwhelmed by debt? Feeling bogged down? It's time to gain momentum and streamline your finances. With a few strategic steps, you can efficiently manage your debt and pave the way for a brighter financial future.

- Start by creating a comprehensive budget that monitors all your income and expenses.

- Identify areas where you can save.

- Consider various debt consolidation options that match your needs and situation.

- Reach out to a reputable financial advisor for tailored guidance.

Remember, managing debt is a journey, not a sprint. Be patient. With determination, you can achieve your financial goals and build a secure future.

Rebuilding Your Financial Future

Feeling overwhelmed by debt? You're not alone. Millions of people battle with debt every day. The good news is, there are steps you can take to achieve control and create a brighter financial future. This journey will outline effective strategies for eliminating your debt and getting yourself on the road to recovery.

- Launch by creating a thorough budget.

- Recognize areas where you can reduce spending.

- Consider different debt consolidation options.

- Consult to a financial advisor for tailored guidance.

Remember, your debt-free future is within reach. With dedication and the right strategies, you can surmount debt and realize lasting financial peace of mind.

End Debt Collector Harassment: Secure Your Future

Are you feeling overwhelmed by relentless debt collectors? Don't let them intimidate you into making wrongful payments. You have rights, and we're here to help you exercise them. Our team of qualified debt collection attorneys can counsel you through the difficult process, ensuring your interests are protected. We offer a range of options tailored to your individual situation.

- Don't signing anything without fully understanding it.

- Keep track all communication with debt collectors.

- Understand of your legal rights under the Fair Debt Collection Practices Act (FDCPA).

Contact us immediately for a free consultation and let us help you take control over your debt situation.

Break Free from Debt: Your New Beginning Starts Now

Are you stressed by debt? Do you dream of living without worry? It's time to turn things around. Getting rid of your debt isn't just achievable, it's within your grasp.

- Develop a realistic budget that works for you.

- Look into different debt repayment options.

- Amplify your income through side hustles or career advancement.

Financial Guidance for Navigating Debt Challenges

Debt can quickly become overwhelming, forcing individuals and families to experience financial stress. It's essential to obtain expert advice during these challenging times. A licensed financial advisor can provide personalized strategies to help you in eliminating your debt effectively.

They will evaluate your current financial situation, pinpoint areas for enhancement, and formulate a detailed plan to reach your debt-reduction objectives.

Utilizing their expertise, you can secure valuable insights and strategies to efficiently navigate your debt challenges.

Remember, requesting professional guidance is a wise decision when confronting debt.

Facing Financial Hardship?

Are you seeking out a proven strategy to manage your debts? Look no further than our compassionate team of experts. We are passionate to guiding you through the complexities of debt elimination. Together, we can formulate a tailored plan that fits your specific needs.

- Our team offers a range of financial solutions to support you achieve financial freedom.

- Reach out with us today for a complimentary assessment.

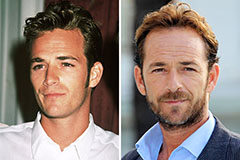

Luke Perry Then & Now!

Luke Perry Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Jaclyn Smith Then & Now!

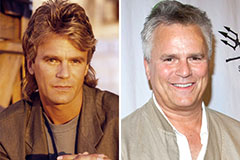

Jaclyn Smith Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!